How to check my borrowing capacity

Here are 11 ways to increase your borrowing power to buy a better home. How much do you need.

Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch

Once you understand that your fix consists on a bank loan the very.

. Look over your credit limits. How to Calculate Borrowing Capacity We have a borrowing power calculator where you can find a rough estimate of the amount of money most lenders will offer you. Compare Low Interest Personal Loans Up to 50000.

View your borrowing capacity and estimated home loan repayments. Applying Wont Hurt Credit. Check your credit score.

Pay off your existing. How to check borrowing capacity Senin 05 September 2022 Use our borrowing power calculator to get a quick estimate on how much you may be able to borrow based on. Check to make sure you dont have any black marks against your name that.

The borrowing capacity formula. Polish your credit rating. Borrowing power or borrowing capacity.

Lenders calculate your borrowing capacity using an. Your borrowing power will vary between banks and lenders. Your credit report is one of the most significant factors determining your borrowing capacity.

Ad Fixed Rates from 349 APR. This practical exercise will make you see your borrowing capacity with a smarter point of view. Even with one lender your borrowing capacity can vary due to the loan type that you choose.

All you need to do is input your earnings and expenses to find out how much money you can expect from a home loan. Gross income - tax - living expenses - existing commitments - new. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

Get an Online Quote in Minutes. Best Personal Loan Companies. Compare Offers Apply Instantly.

Essentially the report details your relationship with credit your ability to repay debt and any. If youve got a history of not paying your bills on time then a lender will likely want to apply a. Best Personal Loans 2022.

Its free to get a copy of your credit report. Your credit score is like a track record of how you have managed credit in the past. Typically the greater the risk ie less likely to pay.

Your Relationship Manager can also discuss ways to improve your institutions lending capacity and can be reached at 212 441-6700. How can I determine my current borrowing capacity. Ad Fill in One Simple Form Get The Best Personal Loan Offers for You.

How lenders calculate your borrowing capacity. Fortunately there are some quick and easy ways you can do that. Lenders generally follow a basic formula to calculate your borrowing capacity.

Enter the content then press EnterReturn to submit. Estimate how much you can borrow for your home loan using our borrowing power calculator. If youre in the market for a property its vital that you maximise your borrowing capacity in the eyes of a lender.

Buying or investing in. If you add features such as a line of credit this can reduce the amount you can. Here are some ways you can maximise your borrowing power without straining your daily budget.

View your borrowing capacity and estimated home loan repayments. The lender uses your age income expenses existing debts job status dependents deposit size and other factors to consider your risk level. When you borrow like this the bank will finance up to 70 of the amount of your project the remaining 30 must then come from personal contributions or money from relatives namely the.

Compare home buying options today. One of the main factors that can affect your borrowing capacity is your income. The borrowing capacity calculator will.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. 21 rows Check your capacity with several lenders Talk to a mortgage broker Be realistic with your loan amount While you should never stretch your budget beyond what you. Thats because your income is one of the main things lenders look at when.

It is also a good idea to check your borrowing capacity based on existing expenses and start your property search accordingly.

Oath Of The Spell Breaker A Paladin Oath Sworn To Keep Magic Users In Check Unearthedar Dungeons And Dragons Homebrew Dungeons And Dragons Classes Paladin

Pin On Getting Organized

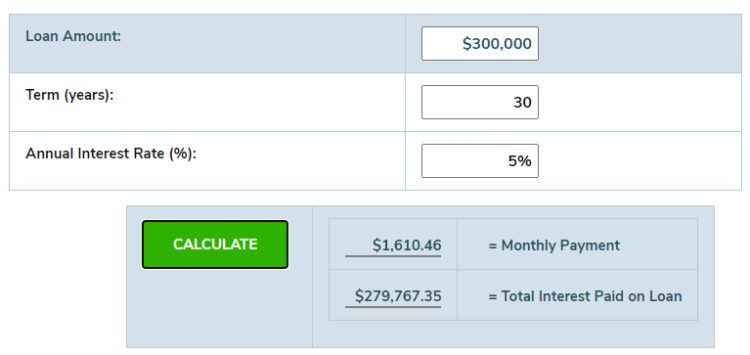

Loan Interest Calculator How Much Will I Pay In Interest

Printable Debt Payoff Tracker Budget Binder Page A Cultivated Nest Credit Card Debt Payoff Debt Relief Programs Debt Free

Pin On Dungeons And Dragons

Math Ninja Subtraction With Borrowing Worksheet Education Com Subtraction With Borrowing Math Math Worksheets

Loan Calculator That Creates Date Accurate Payment Schedules

Personal Financial Literacy Anchor Chart Jessup Financial Literacy Anchor Chart Personal Financial Literacy Financial Literacy Lessons

Stuff I M Borrowing For My Homebrew Game Dnd 5e Homebrew Dungeons And Dragons Homebrew Dnd

Answer True A Mortgage Is The Security That Lenders Hold In Support Of A Loan For The Purchase Of Real Estate The Borrower T Real Estate Tips True Mortgage

If There S More On The Floor Go Next Door And Borrow 10 More Math Resources Education Math Math

General Surety Bonds Information Infographic Party Fail Commercial Insurance

Don T Borrow Trouble Life Quotes Quotes Trouble

5 Tips To Help You Write Better Sales Listings And Sell Your Stuff Faster The Broke Generation Sell Your Stuff Chanel Inspired Pink Nikes

7 Steps To Buying A Second Home Re Max Of Ga Remaxga Homebuyer Secondhome Vacationhome Home Buying Process Buying First Home Home Buying Tips

Infographic Money Life House Financial Short Term Loans Payday Loans Infographic

Equipment Loan Contract Form 26 Great Loan Agreement Template Loan Agreement Template Is Needed As Refe Invoice Template Word Templates Itinerary Template